kansas city vehicle sales tax calculator

That means if you purchase a vehicle in Missouri you will have to pay a minimum of 4225 state. In addition to taxes car.

Dmv Fees By State Usa Manual Car Registration Calculator

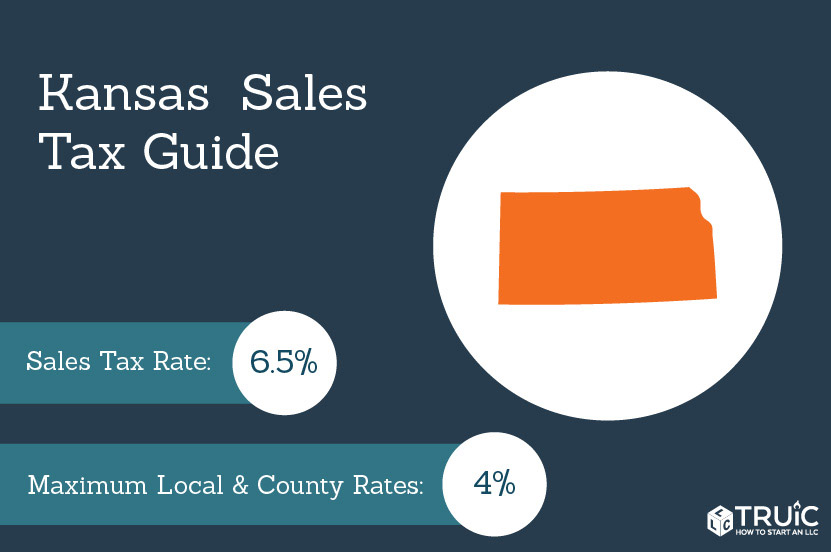

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

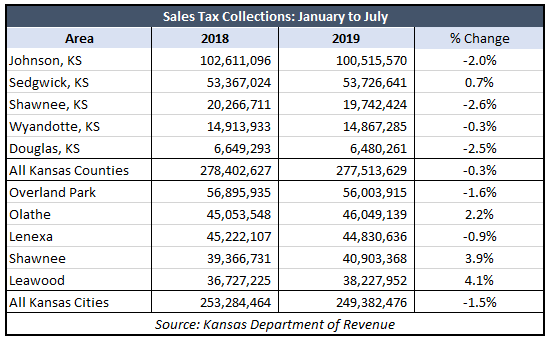

. Maximum Local Sales Tax. This includes the rates on the state county city and special levels. The sales tax in Sedgwick County is 75 percent.

The current state sales tax on car purchases in Missouri is a flat rate of 4225. Kansas Income Tax Calculator 2021. The average cumulative sales tax rate in Kansas City Missouri is 87.

The state sales tax for a vehicle purchase in Missouri is 4225 percent. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local. Tax credits itemized deductions and.

If you have any questions about how Kansas sales and use tax laws apply to your business please visit the departments Policy Information Library on our web site wwwksrevenuegov or. To view current creditdebit card and e-check. Multiply the vehicle price.

Average Local State Sales Tax. The average cumulative sales tax rate in Mcpherson Kansas is 9. How to Calculate Kansas Sales Tax on a Car.

How much is sales tax in Shawnee in Kansas. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. Maximum Local Sales Tax.

Kansas State Sales Tax. If you make 70000 a year living in the region of Kansas USA you will be taxed 12078. The minimum is 65.

635 for vehicle 50k or less. Beginning tax year 2022 all requests for refunds of the earnings tax must comply with Section 68-393 of the Citys Code of Ordinances as amended on March 14 2022. The purchase of a vehicle is also subject to the same potential local taxes mentioned above.

Kansas City has parts of it located within. You may use Visa Mastercard or Discover creditdebit card to pay online at the kiosk or in person at either the Olathe or Mission office. 26 rows Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

Get the protest form. Your average tax rate is 1198 and your marginal tax rate is. The sales tax rate for shawnee was updated for the 2020 tax year this is the current sales tax rate we are using in the shawnee kansas sales tax comparison calculator for.

How kansas motor vehicle dealers should charge sales tax on vehicle sales. Maximum Possible Sales Tax. There are also local taxes up to 1 which will vary depending on region.

The following page will only calculate personal property taxes. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Kansas Sales Tax Calculator And Local Rates 2021 Wise

Sales Tax Bonner Springs Ks Official Website

Sales Tax Amnesty Programs By State Sales Tax Institute

Kansas City Chiefs Kc Log Wordmark Decal Die Cut Vinyl Sticker Laptop Car Window Ebay

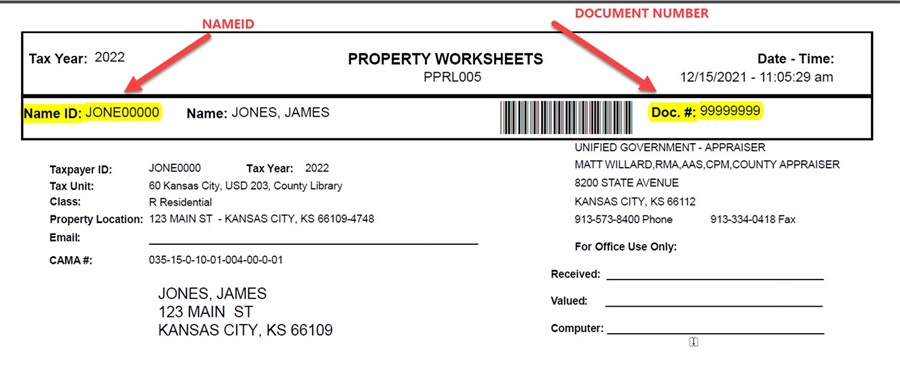

Personal Property Unified Government Of Wyandotte County And Kansas City

Forgivable Loan Home Improvement Program Available For Historic Santa Fe Area Neighborhood Homeowners News Releases Kcmo Gov City Of Kansas City Mo

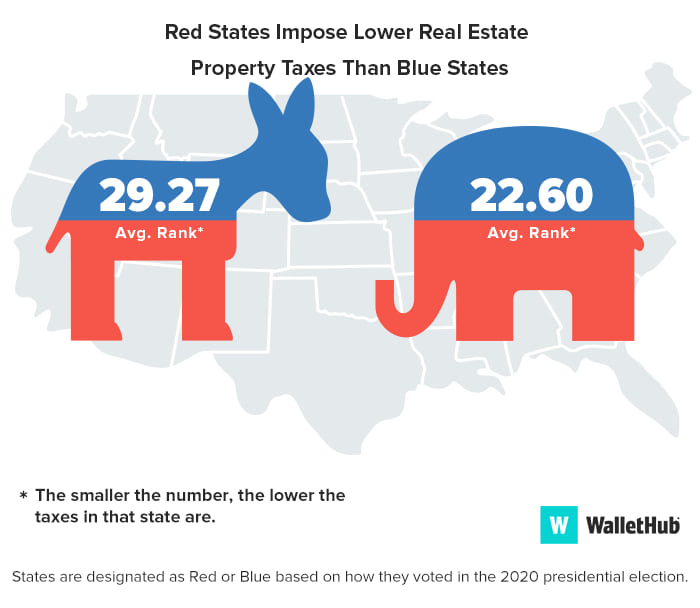

Local Officials Learning Tax Hikes Doom Consumer Spending Kansas Policy Institute

Sales Tax Bonner Springs Ks Official Website

Calculate Auto Registration Fees And Property Taxes Geary County Ks

How To Calculate Tax Title Fees On A Used Car

What States Charge The Least Most In Car Taxes Carvana Blog

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Shipping Containers For Sale Kansas City Conex Box Storage Rentals

Sales Tax On Cars And Vehicles In Kansas

Kansas City Chiefs Logo Nfl Car Truck Window Decal Sticker You Pick The Size Ebay